Market volatility refers to the degree of variation in trading prices over time, often characterized by rapid and significant price movements. It is a natural phenomenon in financial markets, driven by a multitude of factors including economic indicators, corporate earnings reports, and investor sentiment. Volatility can be measured using various statistical methods, with the most common being the standard deviation of returns.

High volatility indicates a greater range of price fluctuations, which can present both opportunities and risks for investors. For instance, during periods of heightened volatility, stock prices may swing dramatically, creating potential for substantial gains or losses within short time frames. The causes of market volatility are multifaceted.

Economic data releases, such as employment figures or inflation rates, can trigger sharp reactions in the markets. Additionally, unexpected news events—ranging from natural disasters to corporate scandals—can lead to sudden shifts in investor confidence. Market psychology plays a crucial role as well; fear and greed can drive irrational behavior, leading to overreactions that exacerbate volatility.

Understanding these dynamics is essential for investors who wish to navigate the complexities of the market effectively. By recognizing the underlying causes of volatility, investors can better prepare themselves for the inevitable fluctuations that characterize financial markets.

Key Takeaways

- Market volatility is a natural part of investing and can be caused by a variety of factors including geopolitical events.

- Geopolitical risk factors such as political instability, trade tensions, and military conflicts can have a significant impact on global markets.

- Geopolitical events can lead to market fluctuations and affect investment performance, but long-term investors should focus on their investment goals and stay the course.

- Strategies for navigating market volatility include diversification, asset allocation, and staying informed about geopolitical risks.

- Diversification and asset allocation are important tools for managing risk and can help investors weather market volatility. Seeking professional financial advice can provide valuable guidance in navigating these challenges.

Geopolitical Risk Factors

Geopolitical risk encompasses the potential for instability or conflict arising from political events or tensions between nations. This type of risk can significantly impact global markets, as it often leads to uncertainty regarding economic policies, trade agreements, and international relations. Factors contributing to geopolitical risk include military conflicts, diplomatic disputes, and changes in government leadership.

For example, tensions between major powers such as the United States and China can lead to trade wars, which may disrupt supply chains and affect global economic growth. The implications of geopolitical risk extend beyond immediate market reactions; they can also influence long-term investment strategies. Investors must consider how geopolitical events may affect specific sectors or regions.

For instance, an escalation in conflict in the Middle East could lead to spikes in oil prices, impacting energy stocks and related industries. Similarly, political instability in emerging markets may deter foreign investment and lead to currency depreciation. As such, understanding the geopolitical landscape is crucial for investors seeking to mitigate risks associated with their portfolios.

Impact of Geopolitical Events on Investments

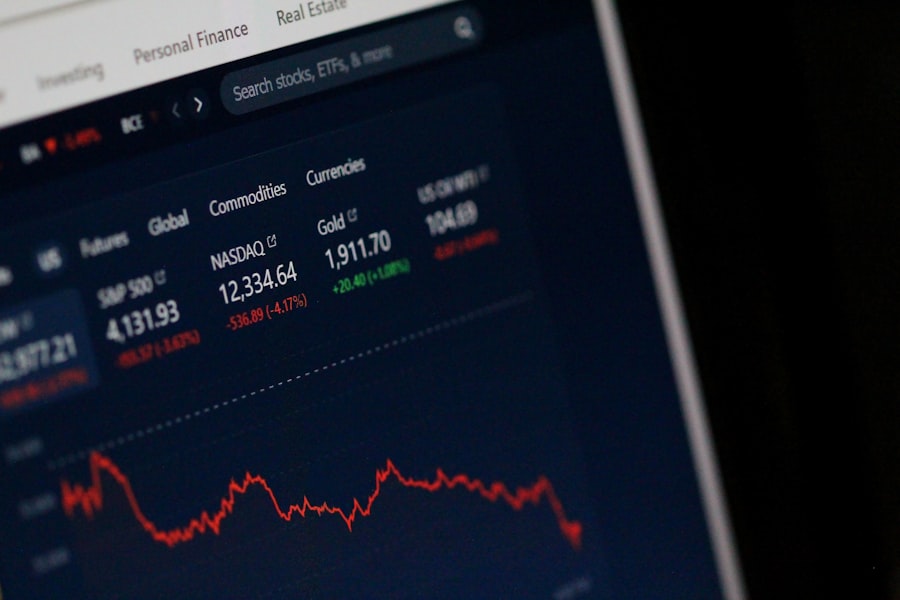

Geopolitical events can have profound effects on investment performance across various asset classes. For instance, during periods of heightened geopolitical tension, investors often flock to safe-haven assets such as gold and U.S. Treasury bonds. These assets tend to retain their value or even appreciate when market sentiment turns negative due to uncertainty. Conversely, equities may experience significant declines as investors react to news of conflict or instability. The stock market’s response can be swift; for example, following the announcement of military action or sanctions, stock indices may drop sharply as traders reassess their risk exposure. Moreover, geopolitical events can lead to sector-specific impacts that investors must navigate. For instance, defense contractors may see their stock prices rise in response to increased military spending during times of conflict. Conversely, industries reliant on global supply chains may suffer if trade routes are disrupted or tariffs are imposed due to political tensions. The interconnectedness of global markets means that a geopolitical event in one region can have ripple effects across the world, influencing everything from commodity prices to currency valuations. Investors must remain vigilant and informed about these developments to make strategic decisions that align with their investment goals.

Strategies for Navigating Market Volatility

| Strategy | Description |

|---|---|

| Diversification | Spreading investments across different asset classes to reduce risk. |

| Asset Allocation | Strategically dividing investments among different asset classes based on risk tolerance and investment goals. |

| Regular Rebalancing | Adjusting the portfolio to maintain the desired asset allocation and risk level. |

| Long-Term Perspective | Focusing on long-term investment goals and avoiding knee-jerk reactions to short-term market fluctuations. |

| Stress Testing | Assessing the impact of potential market scenarios on the portfolio to prepare for volatility. |

Navigating market volatility requires a proactive approach that combines risk management with strategic investment decisions. One effective strategy is to maintain a diversified portfolio that includes a mix of asset classes such as equities, fixed income, and alternative investments. Diversification helps mitigate risk by spreading exposure across different sectors and geographies, reducing the impact of any single investment’s poor performance on the overall portfolio.

For instance, during a market downturn driven by geopolitical tensions, bonds may provide stability while equities decline. Another strategy involves employing tactical asset allocation, which allows investors to adjust their portfolio based on current market conditions. This approach requires continuous monitoring of market trends and economic indicators to identify opportunities for reallocation.

For example, if geopolitical risks are perceived to be rising, an investor might choose to increase their allocation to defensive stocks or commodities while reducing exposure to more volatile sectors like technology or consumer discretionary. By being adaptable and responsive to changing market conditions, investors can better position themselves to weather periods of volatility.

Diversification and Asset Allocation

Diversification is a fundamental principle of investing that aims to reduce risk by spreading investments across various asset classes and sectors. The rationale behind diversification is that different assets often respond differently to market events; when one asset class underperforms, another may perform well, thereby balancing overall portfolio performance. For example, during economic downturns, bonds typically provide a buffer against equity losses due to their inverse relationship with stock prices.

By incorporating a mix of domestic and international equities, fixed income securities, real estate investments, and commodities into a portfolio, investors can enhance their chances of achieving more stable returns over time. Asset allocation complements diversification by determining the proportion of each asset class within an investment portfolio based on an investor’s risk tolerance and investment objectives. A well-structured asset allocation strategy considers factors such as age, financial goals, and market conditions.

Younger investors with a longer time horizon may opt for a higher allocation to equities for growth potential, while those nearing retirement might prioritize capital preservation through increased bond holdings. Regularly reviewing and rebalancing the asset allocation is essential to ensure it remains aligned with changing market dynamics and personal circumstances.

Hedging Against Geopolitical Risks

Hedging is a risk management strategy employed by investors to offset potential losses in their portfolios due to adverse market movements or geopolitical events. Various financial instruments can be used for hedging purposes, including options, futures contracts, and exchange-traded funds (ETFs) designed specifically for this purpose. For instance, an investor concerned about potential declines in equity markets due to geopolitical tensions might purchase put options on major stock indices.

These options provide the right to sell shares at a predetermined price within a specified timeframe, effectively limiting potential losses. Another common hedging strategy involves investing in commodities such as gold or oil, which often serve as safe havens during times of uncertainty. Gold has historically been viewed as a store of value and tends to appreciate when geopolitical risks rise or when inflation concerns emerge.

By allocating a portion of their portfolio to gold or gold-related investments, investors can create a buffer against potential declines in other asset classes during turbulent times. Additionally, currency hedging strategies can be employed to protect against fluctuations in exchange rates that may arise from geopolitical developments affecting specific regions.

Long-Term Investment Perspective

Adopting a long-term investment perspective is crucial for navigating periods of market volatility and geopolitical uncertainty. While short-term fluctuations can be unsettling and may tempt investors to react impulsively, maintaining focus on long-term goals can help mitigate emotional decision-making. Historically, markets have shown resilience over extended periods despite experiencing significant downturns due to geopolitical events or economic crises.

For instance, following the 2008 financial crisis triggered by the housing market collapse and subsequent global recession, equity markets eventually rebounded and reached new highs within a few years. Investors who maintain a long-term outlook are better positioned to capitalize on market recoveries and benefit from compounding returns over time. This perspective encourages individuals to stay invested through market cycles rather than attempting to time their entry and exit points based on short-term news events or fluctuations.

By consistently contributing to their investment accounts—such as through dollar-cost averaging—investors can take advantage of lower prices during downturns while building wealth over time.

Seeking Professional Financial Advice

In an increasingly complex financial landscape characterized by market volatility and geopolitical risks, seeking professional financial advice can be invaluable for investors at all levels of experience. Financial advisors possess the expertise necessary to help individuals navigate these challenges by providing tailored investment strategies aligned with their unique goals and risk tolerance. They can offer insights into current market conditions and recommend appropriate asset allocation strategies that account for both short-term volatility and long-term objectives.

Moreover, professional advisors can assist in developing comprehensive financial plans that encompass not only investment strategies but also retirement planning, tax optimization, and estate planning considerations. This holistic approach ensures that all aspects of an individual’s financial life are coordinated effectively. Additionally, financial advisors can provide ongoing support through regular portfolio reviews and adjustments based on changing market conditions or personal circumstances.

By leveraging their knowledge and experience, investors can make informed decisions that enhance their chances of achieving financial success amidst uncertainty.

FAQs

What are geopolitical risks?

Geopolitical risks refer to the potential impact of political, social, and economic factors on global markets and investment opportunities. These risks can arise from events such as wars, political instability, trade disputes, and regulatory changes.

How do geopolitical risks impact markets?

Geopolitical risks can lead to market volatility, as investors react to uncertainty and potential disruptions to global trade and economic stability. These risks can affect the prices of stocks, commodities, and currencies, as well as the overall performance of financial markets.

What are some examples of geopolitical risks impacting markets?

Examples of geopolitical risks impacting markets include trade tensions between major economies, military conflicts in key regions, political instability in important trading partners, and regulatory changes that affect international business operations.

How do investors respond to geopolitical risks?

Investors may respond to geopolitical risks by adjusting their investment portfolios, hedging against potential market downturns, or seeking out safe-haven assets such as gold or government bonds. They may also closely monitor geopolitical developments and adjust their investment strategies accordingly.

What are the long-term implications of geopolitical risks on markets?

Geopolitical risks can have long-term implications on markets, including changes in global supply chains, shifts in investment patterns, and alterations to economic policies. These risks can also impact consumer confidence, business investment decisions, and overall economic growth.